In March this year, EFG Group opened a new investment fund Energy financial group Fund SICAV a.s. Through this fund, or rather through the Green gas & energy sub-fund, the company plans to invest more than CZK 3 billion. The fund is intended to be a key instrument to ensure efficient financing of projects of Energy financial group a.s. (EFG) and to fulfil its strategic objectives.

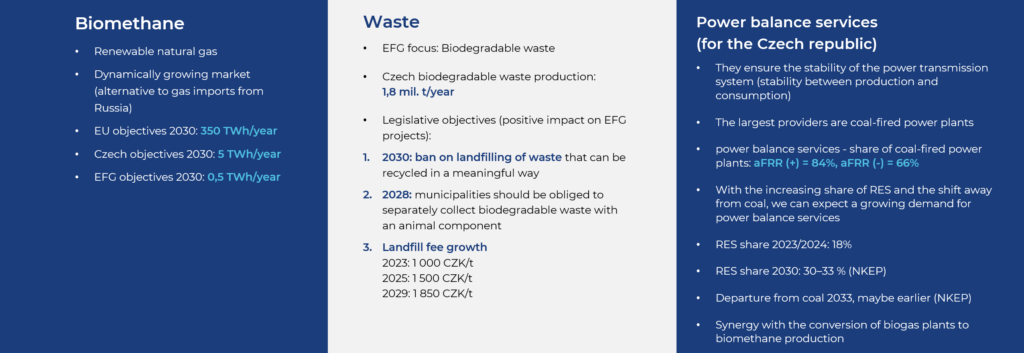

With the launch of the fund, EFG Group builds on its existing investment activities in biomethane production and the provision of power balance services (PBS), while the role of the newly created Energy financial group Fund SICAV is to strengthen the company’s position and ensure further efficient financing of its strategic projects.

The newly established fund is supervised by the Czech National Bank, the depositary is Komerční banka and the manager and administrator is NWD. “We chose NWD mainly because of its more than 20 years of experience in the field of investment funds. By connecting this experience in the capital markets and the Energy financial group’s more than nine years of experience in the modern energy sector, we have achieved a synergy that has resulted in the creation of a high-quality investment fund that offers investors interesting opportunities in strategically important sectors,” said EFG Group CEO Tomáš Voltr.

The Energy financial group aims to develop a biomethane production capacity of 500 GWh per year by 2030. Its other major activity is the provision of power balance services, where it targets a total flexible capacity of 70-75 MW by 2030. Its annual biomethane production capacity is to be increased from the current 70 GWh to 100 GWh as early as 2025. The flexible capacity for SVR is to be increased to 35-40 MW in that year.

The fund will invest in verified energy projects in the Czech Republic and other European countries through the Green gas & energy sub-fund. All these resources will be allocated to the areas of biomethane production and the provision of power balance services. The total amount of planned investments until 2030 exceeds CZK 3 billion. Already in 2025, the fund will have assets under management worth around 600 million crowns, and by 2030 their value should exceed 6 billion crowns. The fund will be open to qualified investors and will target a return in excess of 8-12 % p.a. Around 80 % of the investments will be allocated to biomethane production and 20 % to SVR.

“I am delighted to welcome EFG Group to our family of funds and to participate in its expansion. We look at the fund not only as a manager but also as investors. In this regard, we particularly appreciate the unique business model of the company, which is a leader in domestic biomethane production, and especially the source of its income, which comes from both the processing of waste and the sale of the produced biomethane.

A bonus is the income from power balance services. Another positive factor is that the very decent profitability is not dependent on subsidies. The fund itself has a fair fee structure with management incentives to increase value for investors. Therefore, we are convinced that we have a very promising investment opportunity in front of us,” says Štěpán Tvrdý, director of NWD, the administrator of the new fund.

The fund will complement existing bond financing, while one of its roles will also be to improve the return on invested capital by bringing appropriate bank financing into operating projects. “All of the projects we invest in go through a thorough selection process and are subject to a rigorous risk and return assessment. The expected return of 8-12% p.a. is based on our track record and the actual performance of the existing facilities in our portfolio. The investment horizon of five years reflects the current dynamics of the energy market and allows us to optimize the return on invested funds,” says the Group’s CEO.

The main vision and goal of the Energy financial group is to contribute to the promotion of sustainable development and the stabilisation of the energy sector, which is currently undergoing the biggest transformation since the Industrial Revolution. In this context, biomethane also has an important role to play in the EU’s strategic objectives to replace up to 20% of the original natural gas imports from Russia by 2030.

“The pressure for emission reduction, decentralisation and security in terms of eliminating geopolitical risks brings a number of challenges and investment opportunities in the modern energy sector. Biomethane, as a local resource, is an important part of this transformation and has the potential to contribute to reducing dependence on foreign natural gas imports into the EU. This is why we have decided to open a new fund that does not represent a change in the EFG Group’s existing strategy, but instead strengthens our position as a market leader and enables us to systematically develop our activities in the field of sustainable energy,” concludes Voltr.

More information about Energy financial group Fund SICAV is available on the website efg-holding.cz/fund.

*Energy financial group a.s. together with Energy financial group Fund SICAV a.s. form a business group whose controlling person is EFG Group a.s.